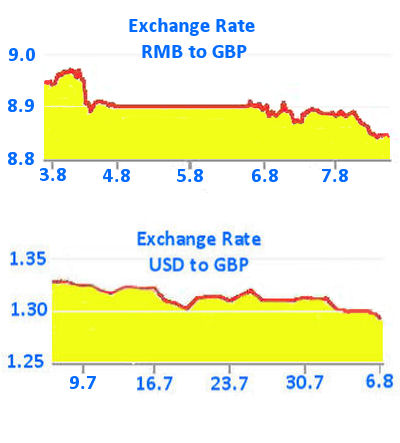

George Carney Governor of the Bank of England pulled off an amazing feat – increasing interest rates and at the same time getting the value of Stirling to fall. Perhaps it was a clever move to deliver his assessment of the risk of a ‘no deal Brexit’ and the gloomy forecast to accompany that scenario at the same time as announcing the rise in interest rates. News which was bound on its own to lead to a marked depreciation in the pound. The result an immediate fall on receipt of the news with further falls following the weekend.

We always knew the road to Brexit would be rocky with waves along the way so we should not be surprised by this and indeed should expect more fluctuations over the coming months. We may well see increasing volatility in the Stirling exchange rate markets over the coming months.

If you are running a business which trades overseas such volatility is not helpful, and whilst there may be gains there may also be losses too and most businesses will wish to minimise this risk. Our experience is certainly that most companies we deal with are not in the business of ‘currency gambling’ and want certainty that there transaction costs will come in on budget. Thankfully there are measures one can take to help minimise these risks. Typically if purchasing from China once a price is fixed and an order placed there will be a 4-6 week manufacturing time before final payment is required. We recommend that many of our customers take advantage of our forward buying facilities to guarantee the future exchange rate when it comes to paying the balance of the order.

Every cloud has a silver lining and in this case if you are looking to purchase from countries such as China your products have just got a little cheaper!

Interest rates rise – The Pound falls!